Greeks Tracking

Monitor Delta, Gamma, Theta, Vega, and IV for your option trades with real-time data and AI analysis.

Greeks tracking helps you understand the risk characteristics of your option positions. Option Tracker displays real-time Greeks data directly on your trades, allowing you to filter positions and get AI-powered analysis.

What Are Greeks?

Greeks are measurements that describe how an option's price changes in response to various factors:

| Greek | What It Measures | |-------|------------------| | Delta | Price sensitivity to stock movement ($1 stock move) | | Gamma | Rate of change of delta | | Theta | Time decay (daily dollar loss) | | Vega | Sensitivity to volatility changes | | IV | Implied Volatility (market's expected price movement) |

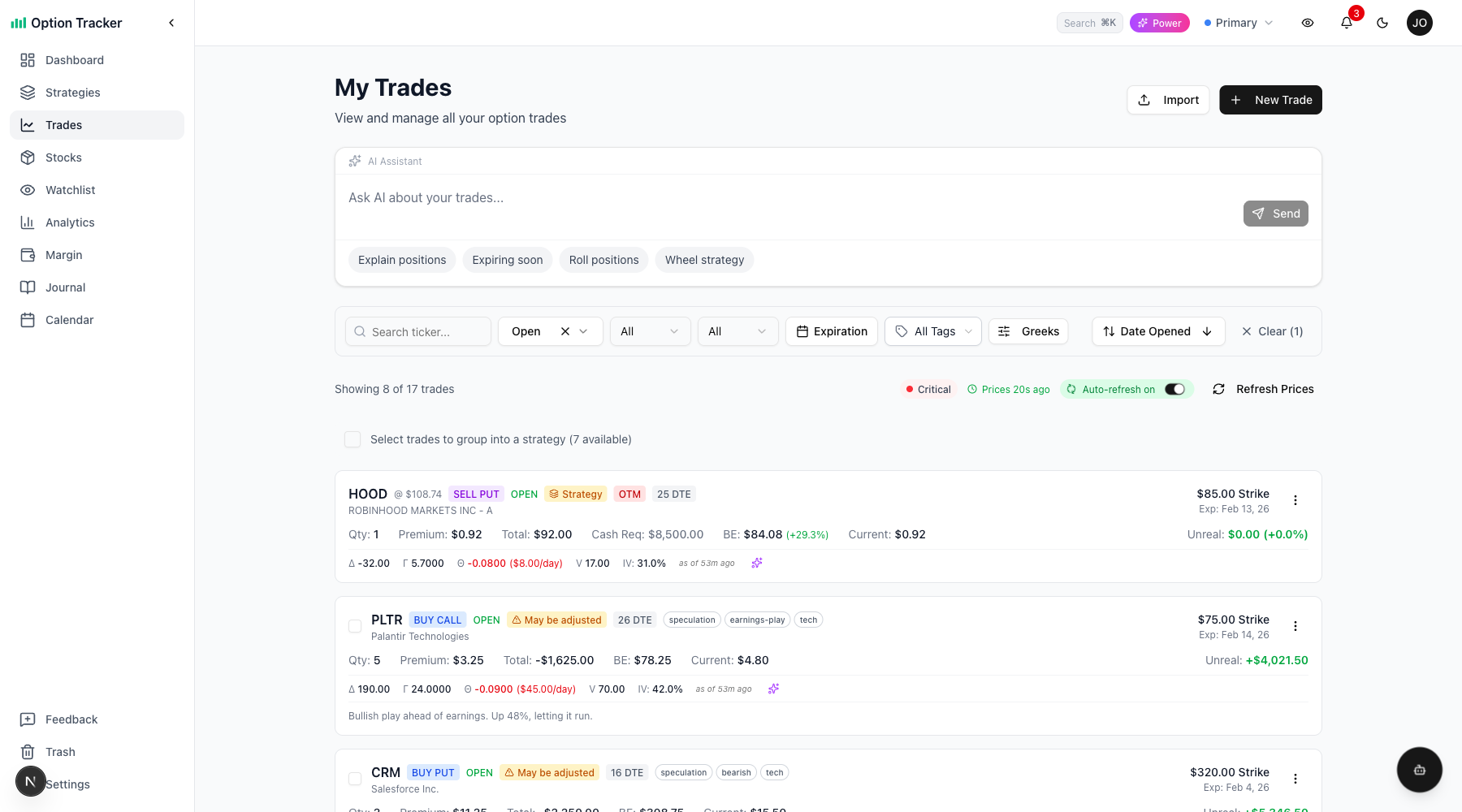

Viewing Greeks on Trades

Greeks are displayed automatically on all open option trades when available:

On Trade Cards

Each trade card shows the key Greeks below the trade details:

- Delta (Δ) - Position delta for the trade

- Theta (Θ) - Daily time decay in dollars

- IV - Current implied volatility percentage

Expanded Trade View

Click on any trade to see the full Greeks breakdown including Gamma and Vega.

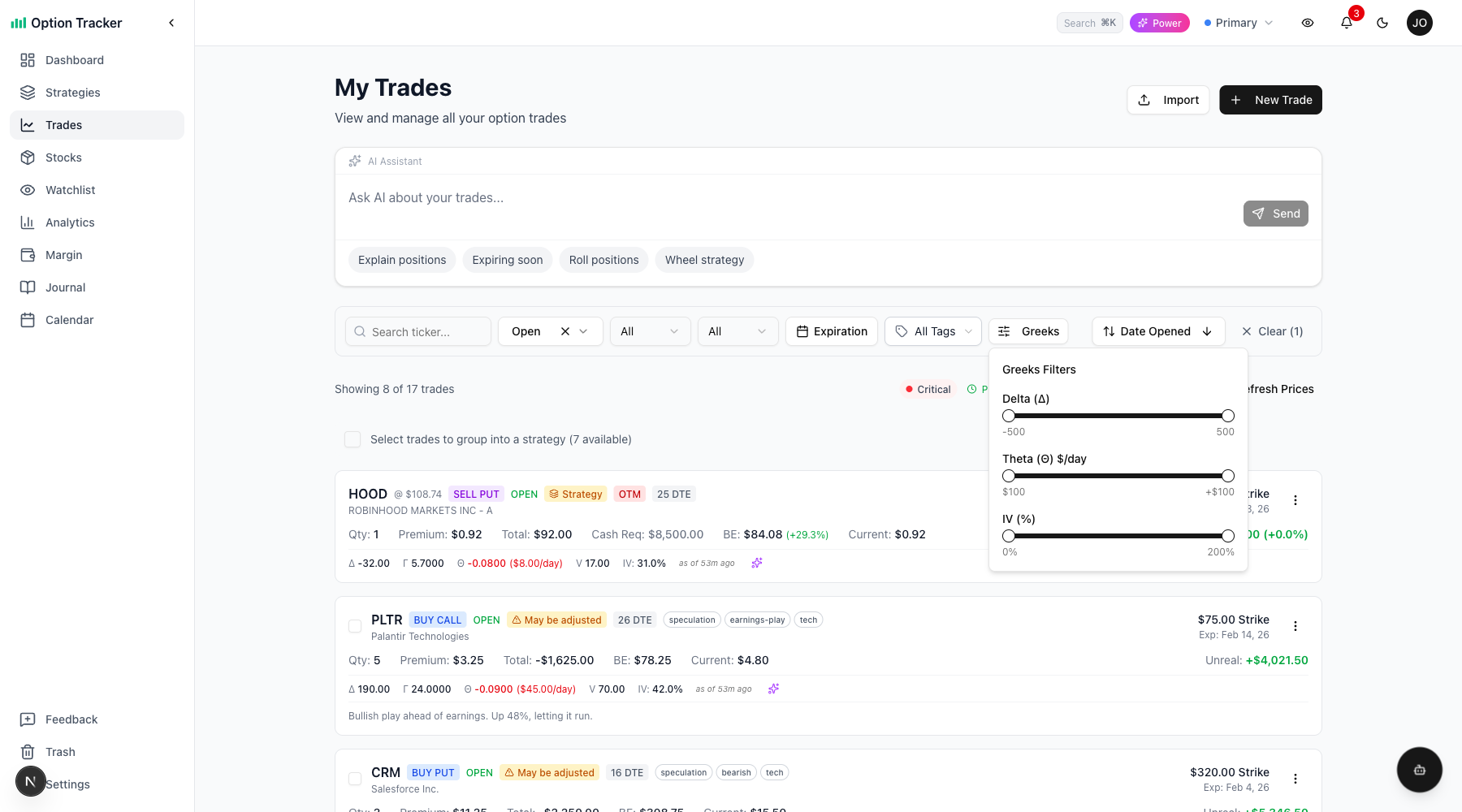

Filtering by Greeks

Use the Greeks filter to find trades matching specific criteria:

Available Filters

- Delta Range - Filter by position delta (e.g., find high-delta trades)

- Theta Range - Filter by daily time decay

- IV Range - Filter by implied volatility percentage

Filter Examples

| Goal | Filter Setting | |------|----------------| | High-delta positions | Delta: 0.7 to 1.0 | | High theta decay | Theta: -$50 to -$200 | | High IV trades | IV: 50% to 100%+ | | Low-risk positions | Delta: 0.1 to 0.3 |

Position-Level Greeks

Greeks displayed are position-adjusted:

- Position Delta = Per-contract delta × contracts × 100

- Position Theta = Per-contract theta × contracts × 100 (daily $ decay)

- IV = Same as contract level (not multiplied)

For example, if you sold 5 contracts with a delta of 0.30:

- Position Delta = 0.30 × 5 × 100 = 150

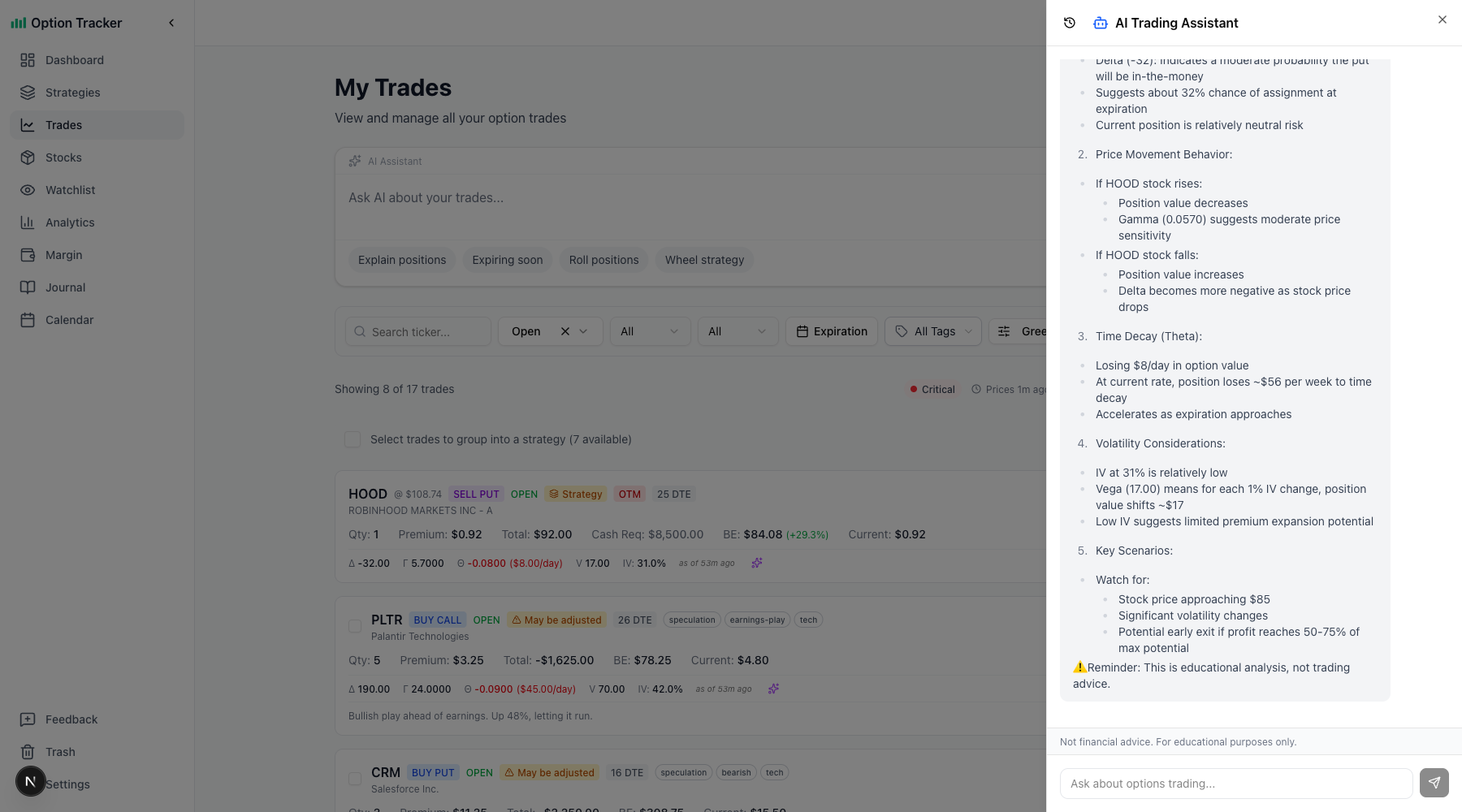

AI Greeks Analysis

The AI assistant can analyze your Greeks exposure. Click the AI panel and ask:

Suggested Questions

- "Analyze my Greeks exposure"

- "Which trades have the highest theta decay?"

- "What's my total portfolio delta?"

- "Which positions are most sensitive to volatility?"

The AI considers your entire portfolio when providing analysis and recommendations.

Greeks Data Sources

Greeks are fetched from live market data and cached for performance:

- Data Source: Polygon.io via Massive API

- Update Frequency: On page load and manual refresh

- Cache Duration: Data cached until next refresh

Refreshing Greeks

Click the Refresh Prices button to fetch the latest Greeks data for all open trades. This also updates live option prices.

Understanding Greeks for Wheel Strategy

For Cash-Secured Puts (Selling Puts)

| Greek | What to Watch | |-------|---------------| | Delta | Lower delta (0.20-0.35) = less likely to be assigned | | Theta | Higher theta = faster premium decay (good for sellers) | | IV | Higher IV = bigger premiums but more risk |

For Covered Calls (Selling Calls)

| Greek | What to Watch | |-------|---------------| | Delta | Lower delta = less likely to be called away | | Theta | Positive theta decay works in your favor | | IV | Sell when IV is elevated for better premiums |

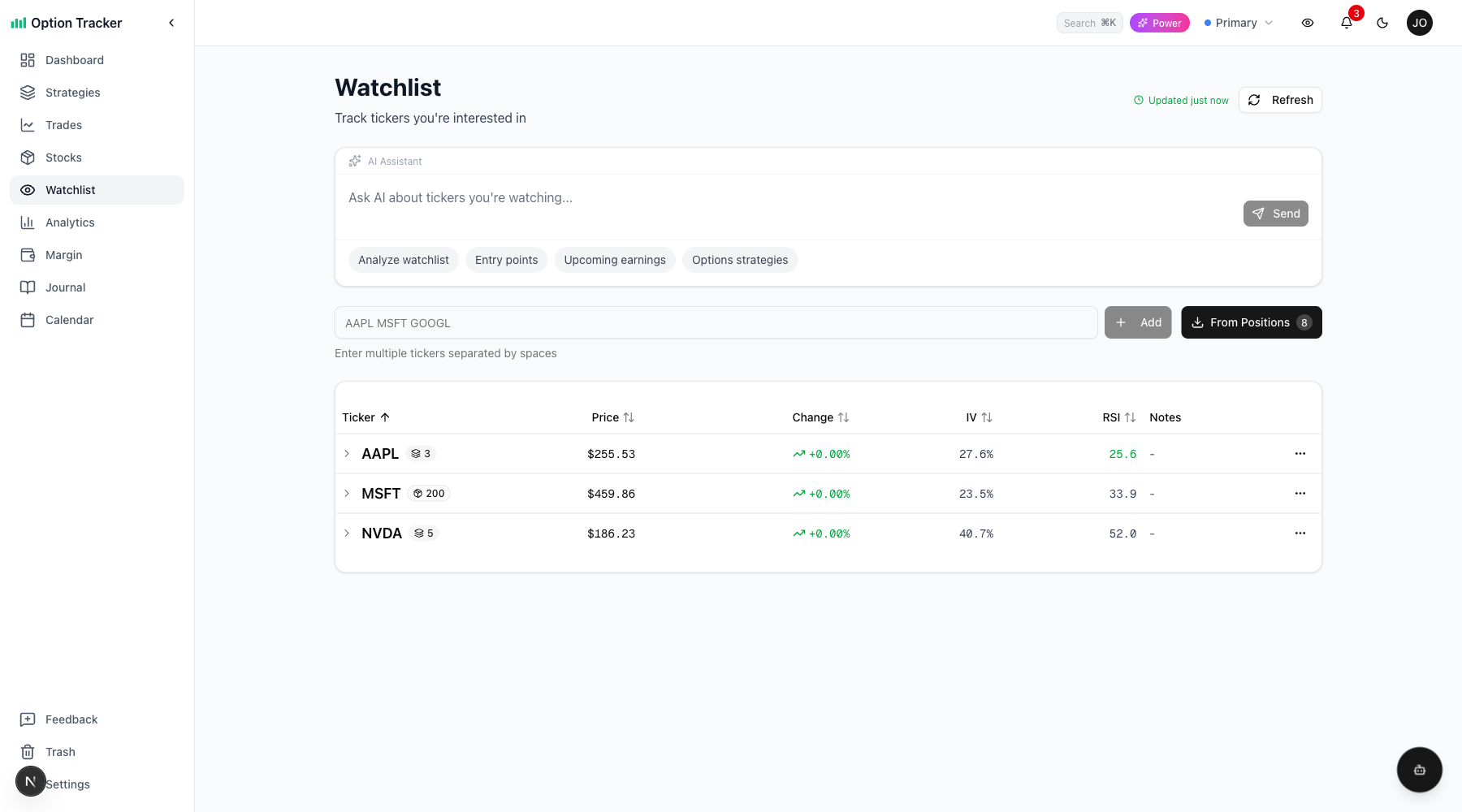

Watchlist IV and RSI

The watchlist also tracks market indicators for each ticker:

- ATM IV - At-the-money implied volatility for the stock

- RSI - Relative Strength Index (14-day)

These help you identify opportunities before entering trades.

Tips for Using Greeks

Monitor Theta Daily

- Time decay accelerates as expiration approaches

- Check total portfolio theta to understand daily decay

Watch Delta for Assignment Risk

- Higher delta = higher probability of assignment

- Consider rolling when delta gets too high

Use IV for Entry/Exit Timing

- Enter positions when IV is elevated (higher premiums)

- Consider closing early when IV drops significantly

Portfolio-Level Analysis

- Sum position deltas for net portfolio exposure

- Use AI analysis for quick portfolio risk summary

Troubleshooting

Greeks Not Showing

If Greeks aren't displaying:

- Ensure the trade has a valid OCC symbol (matched contract)

- Click Refresh Prices to fetch latest data

- Check that the option hasn't expired

Stale Data

Greeks are cached for performance. If data seems outdated:

- Click Refresh Prices button

- Wait for the refresh indicator to complete

- Greeks update along with live prices

Next Steps

- Learn about Live Pricing for real-time option prices

- Explore Multi-leg Strategies for complex positions

- Use the AI Assistant for portfolio analysis