Covered Calls

Generate income by selling covered calls against your stock positions.

Covered calls are a popular income-generating strategy where you sell call options against stock you already own. Option Tracker makes it easy to track these trades and link them to your underlying positions.

What is a Covered Call?

A covered call involves:

- Owning stock (at least 100 shares per contract)

- Selling a call option at a strike price above current price

- Collecting premium as immediate income

- Obligation to sell if the stock reaches the strike price

Why Sell Covered Calls?

- Generate income on stocks you already own

- Lower cost basis of your position

- Define an exit price you're happy to sell at

- Profit in flat markets when the stock doesn't move much

Selling a Covered Call

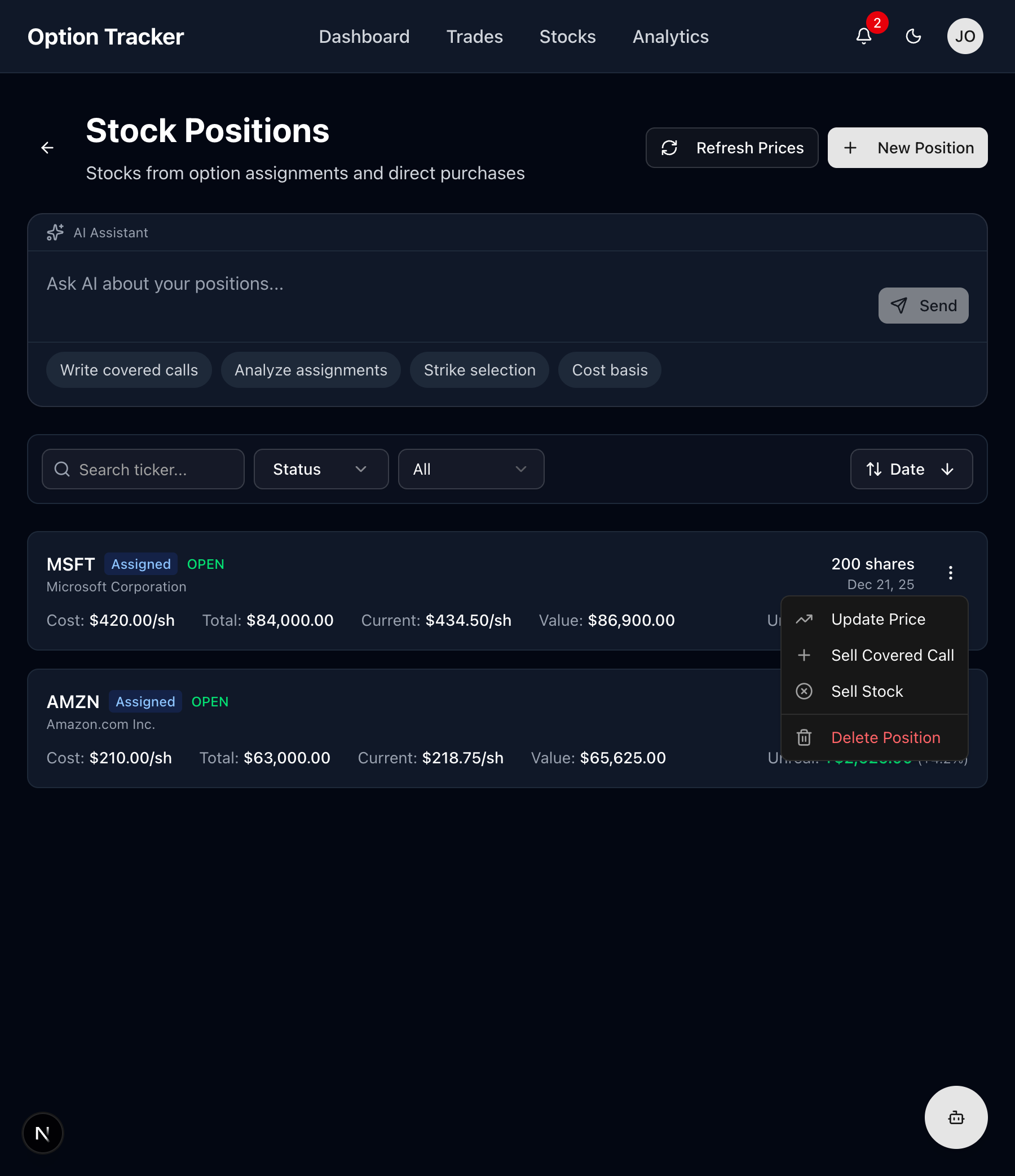

From the Stocks page, find the position you want to write a call against.

Step 1: Open the Action Menu

Click the three-dot menu on your stock position.

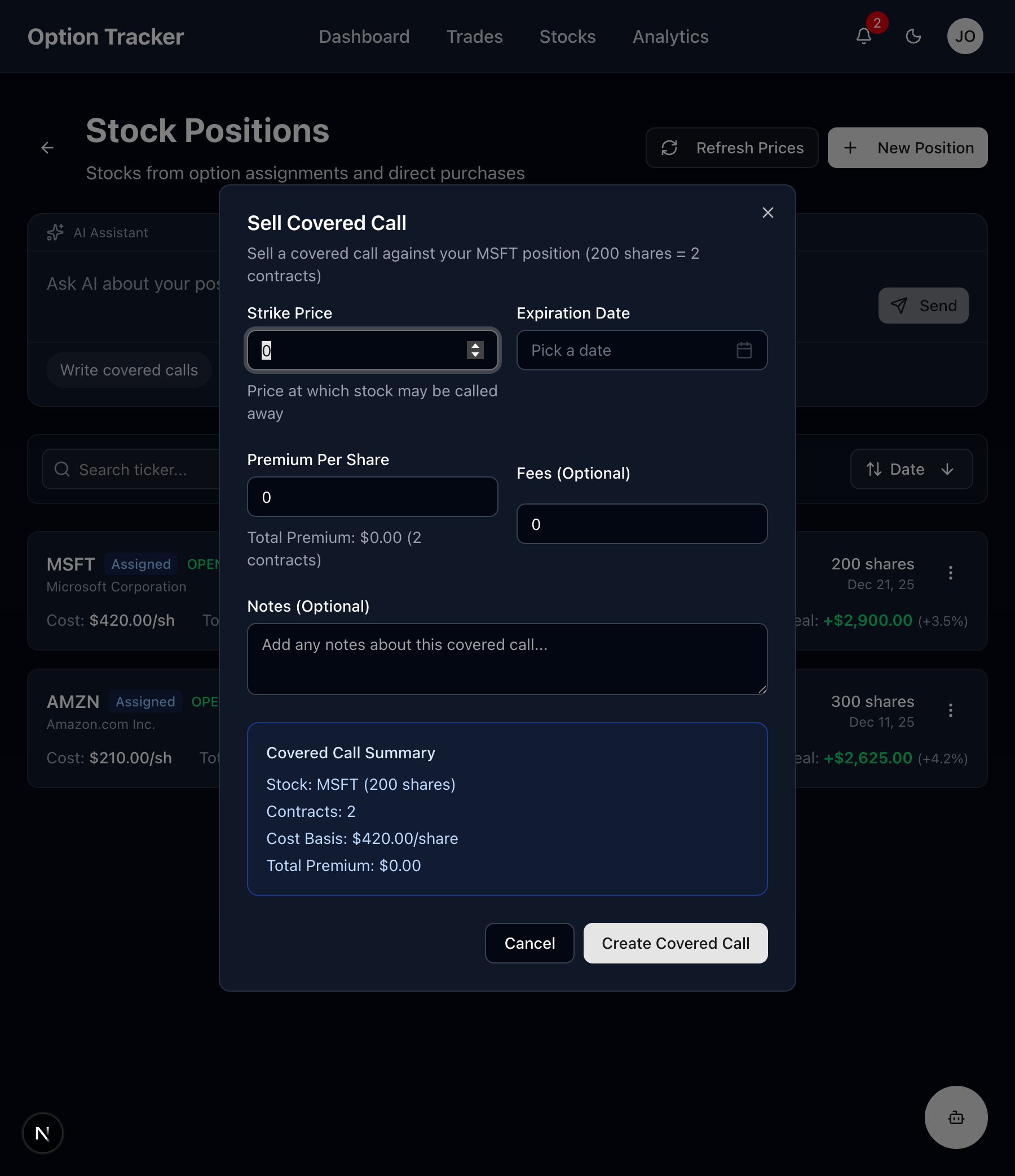

Step 2: Select "Sell Covered Call"

This opens the covered call form pre-filled with your position details.

Step 3: Enter Call Details

-

Strike Price - The price at which you agree to sell your shares

- Choose above current price for best results

- Higher strike = less premium but less likely to be called

-

Expiration Date - When the option expires

- 30-45 days is common (optimal time decay)

- Weekly options for more frequent income

-

Premium Per Share - What you receive per share

- System calculates total: Premium × Contracts × 100

-

Fees (Optional) - Broker commissions

-

Notes (Optional) - Strategy notes, target profit, etc.

Step 4: Review Summary

The Covered Call Summary shows:

- Stock being covered (ticker and shares)

- Number of contracts (shares ÷ 100)

- Your cost basis for reference

- Total premium you'll receive

Step 5: Create the Call

Click "Create Covered Call" to record the trade.

Understanding the Numbers

Maximum Contracts

You can sell 1 call contract per 100 shares owned:

| Shares Owned | Max Contracts | |--------------|---------------| | 100 | 1 | | 200 | 2 | | 500 | 5 | | 1000 | 10 |

Premium Calculation

Total Premium = Premium per Share × Contracts × 100

Example:

- Own 300 shares of AAPL

- Sell 3 calls at $2.50 premium

- Total premium: $2.50 × 3 × 100 = $750

Break-Even with Covered Call

Break-Even = Cost Basis - Premium Received per Share

Example:

- Cost basis: $150/share

- Received: $2.50 premium

- New break-even: $147.50/share

Managing Covered Calls

Once created, covered calls appear in your Trades list linked to the stock position.

Possible Outcomes

-

Expires Worthless (Stock below strike)

- Keep all premium

- Keep your shares

- Can sell another call

-

Called Away (Stock above strike at expiration)

- Shares sold at strike price

- Keep the premium

- Stock position closed

-

Buy to Close (Close early)

- Pay to close the position

- Keep shares

- Realize partial profit/loss

Tracking Linked Positions

Option Tracker links covered calls to their underlying stock:

- View covered call status from stock position

- See combined P&L (stock + call premium)

- Track multiple rounds of covered calls

Covered Call Strategies

Conservative (Deep Out-of-the-Money)

- Strike 10-15% above current price

- Lower premium, lower chance of assignment

- Best when you want to keep shares long-term

Moderate (Slightly Out-of-the-Money)

- Strike 3-5% above current price

- Balanced premium and assignment risk

- Common for income investors

Aggressive (At-the-Money)

- Strike near current price

- Higher premium, higher assignment risk

- Best when willing to sell at current prices

Rolling Covered Calls

When a call is about to be assigned but you want to keep shares:

- Buy to close the current call

- Sell to open a new call at:

- Same or higher strike

- Later expiration

- Ideally collect net credit

This is called "rolling up and out."

AI Assistant for Covered Calls

The stocks page AI can help with:

- Strike selection - Optimal strikes for your risk tolerance

- Premium analysis - Expected returns at different strikes

- Roll timing - When to roll vs. take assignment

Best Practices

-

Only sell calls on stock you'd sell - Be comfortable with assignment

-

Start with 30-45 DTE - Optimal time decay (theta)

-

Target 1-2% monthly - Reasonable income expectation

-

Watch earnings - Avoid selling calls through earnings if bullish

-

Have an exit plan - Know when you'll roll or take assignment

-

Track your cost basis - Premium lowers your effective cost

Example: Complete Wheel Cycle

Here's how covered calls fit into the wheel strategy:

-

Sell Cash-Secured Put ($150 strike, $3 premium)

- Stock at $155, put expires worthless

- Profit: $300 (kept premium)

-

Sell Another Put ($150 strike, $2.50 premium)

- Stock drops to $148, assigned at $150

- Cost basis: $150 - $2.50 = $147.50

-

Sell Covered Call ($155 strike, $2 premium)

- Stock rises to $156, called away

- Profit: ($155 - $147.50) × 100 + $200 = $950

Total profit from cycle: $300 + $950 = $1,250