Analytics

Analyze your trading performance with detailed charts, metrics, and insights.

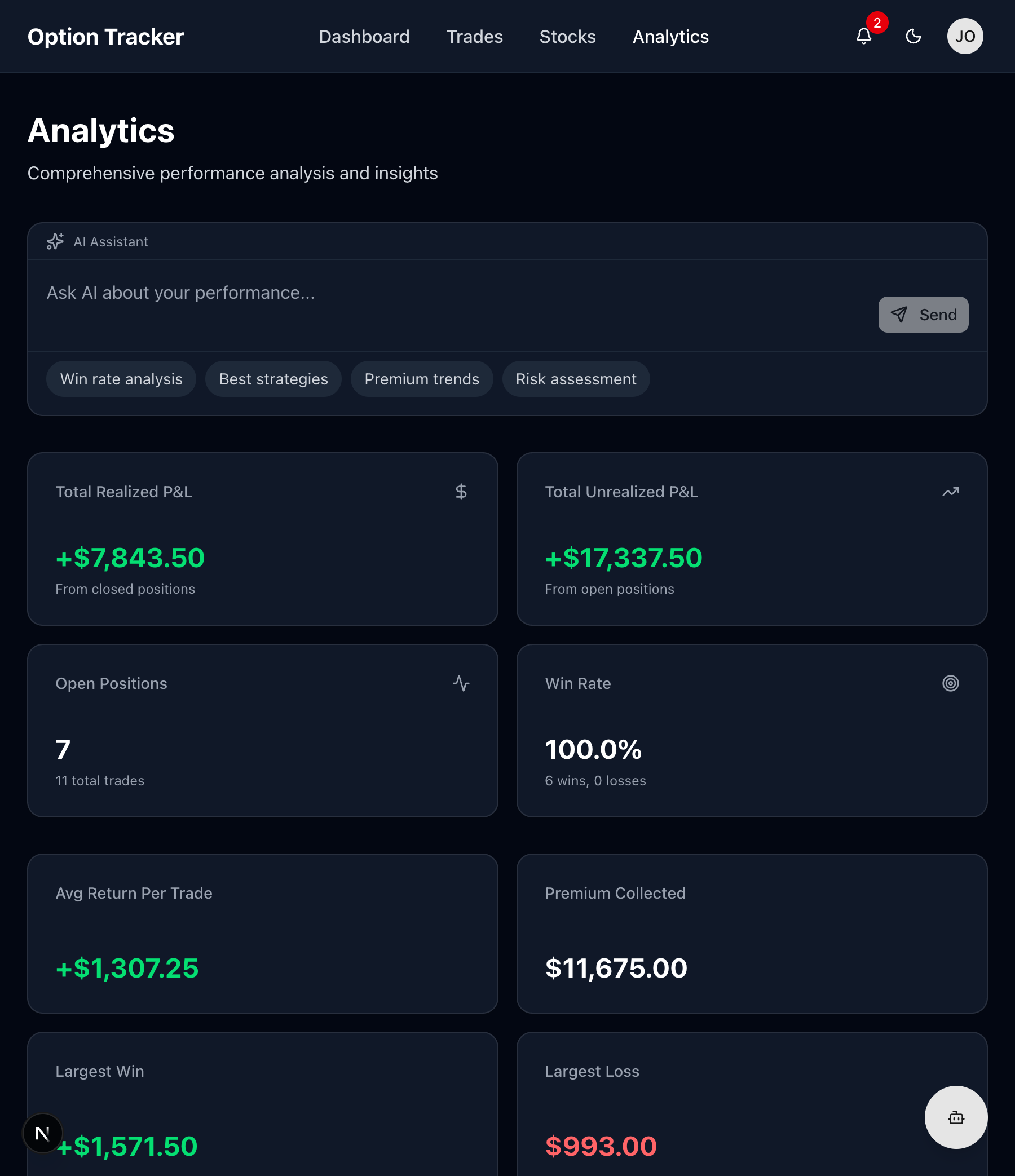

The Analytics page provides comprehensive insights into your trading performance, helping you identify strengths, weaknesses, and opportunities for improvement.

Analytics Overview

Navigate to Analytics from the main navigation to access your performance dashboard.

Key Performance Metrics

Win Rate

Your success rate across all closed trades:

Win Rate = (Profitable Trades / Total Closed Trades) × 100

Interpreting Win Rate:

- 60%+ - Strong performance

- 50-60% - Average, look for improvements

- Below 50% - Review your strategy

Average Return

Mean profit/loss per trade:

Average Return = Total Realized P&L / Number of Closed Trades

This helps you understand your typical trade outcome.

Best & Worst Trades

Quickly identify:

- Your most profitable trade

- Your largest loss

- Learn from both extremes

Total Premium Collected

For option sellers, this shows total premium received across all sold options (puts and calls).

Total Fees Paid

Track your trading costs:

- Broker commissions

- Per-contract fees

- Helps evaluate if fees are eating into profits

Performance Charts

P&L Over Time

A line chart showing your cumulative realized P&L over time:

- Upward trend - Consistent profitability

- Plateaus - Periods of consolidation

- Dips - Losing streaks to analyze

Use this to identify:

- Seasonal patterns

- Impact of market conditions

- Strategy effectiveness over time

Monthly Returns

Bar chart showing profit/loss by month:

- Green bars = profitable months

- Red bars = losing months

- Compare month-over-month performance

Trade Distribution

Pie charts showing breakdown by:

- Option Type - Calls vs. Puts

- Action - Buys vs. Sells

- Status - Open, Closed, Expired, Assigned

Understand your trading style and diversification.

Trade Analysis

By Ticker

See which stocks are most profitable:

| Ticker | Trades | Win Rate | Total P&L | |--------|--------|----------|-----------| | AAPL | 15 | 73% | +$2,450 | | MSFT | 12 | 58% | +$890 | | TSLA | 8 | 50% | -$320 |

Focus on tickers where you perform best.

By Strategy

Compare performance across strategies:

- Selling Puts - CSP strategy results

- Selling Calls - Covered call income

- Buying Options - Directional trades

By Expiration Length

Analyze results by days to expiration:

- Weekly (0-7 DTE) - Short-term trades

- Monthly (21-45 DTE) - Standard options

- LEAPS (180+ DTE) - Long-term positions

Find your optimal timeframe.

Using the AI Assistant

The Analytics page includes AI-powered analysis:

Suggested Queries

- "What's working best?" - Identify successful patterns

- "Where am I losing money?" - Find areas to improve

- "Compare calls vs puts" - Strategy comparison

- "Monthly performance review" - Detailed breakdown

Custom Analysis

Ask specific questions like:

- "What's my win rate on AAPL puts?"

- "How much premium have I collected this quarter?"

- "What's my average holding period for winners?"

Filtering Analytics

Narrow your analysis using filters:

Date Range

- Last 7 days

- Last 30 days

- Last 90 days

- Year to date

- All time

- Custom range

By Status

Focus on:

- All trades

- Only closed positions

- Only assigned trades

By Type

- All options

- Calls only

- Puts only

- Stock positions

Exporting Data

Export your trading data for external analysis:

- Click "Export" button

- Choose format (CSV or PDF)

- Select date range

- Download your data

Use exports for:

- Tax reporting

- Spreadsheet analysis

- Backup records

Interpreting Your Analytics

Signs of a Good Strategy

- Win rate above 50%

- Positive average return

- Consistent monthly profits

- Low maximum drawdown

Warning Signs

- Declining win rate over time

- Large losses outweighing small wins

- Overconcentration in few tickers

- High fee ratio to profits

Questions to Ask

- Which strategies are profitable? Compare selling vs. buying options

- Am I diversified? Check ticker distribution

- What's my edge? Find patterns in winners

- Where do I struggle? Identify losing patterns

Improving Your Performance

Based on analytics, consider:

If Win Rate is Low

- Tighten entry criteria

- Use longer expirations

- Stick to high-probability setups

If Average Loss > Average Win

- Use stop losses

- Size positions appropriately

- Cut losers faster

If Fees Are High

- Trade less frequently

- Use larger position sizes

- Consider broker alternatives

Tracking Progress

Review analytics regularly:

- Daily - Quick P&L check

- Weekly - Review open positions

- Monthly - Full performance review

- Quarterly - Strategy adjustments